Chancellor Jeremy Hunt’s Spring Budget delivered on 15th March 2023; it sees corporation tax rise to 25%, the highest rate since 2012. The 19% rate was one of the most competitive in the world, and now at 25%, the UK’s top rate is now above the EU27 average rate of 21.16%.

Corporation Tax

For those investors who have their property assets held in a company structure this will be important.

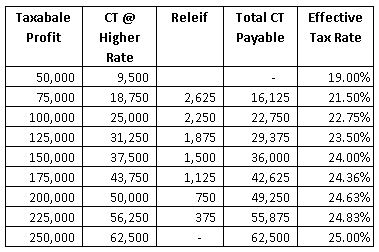

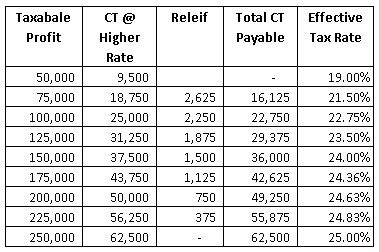

As expected, from April 2023, companies with profits over £250,000 will be subject to a corporation tax rate of 25%. Those with profits of £50,000 or less will be eligible for the small profits rate of 19%. Companies with profits between £50,001 and £250,000 will pay the main rate of tax, with a marginal relief to gradually increase the effective corporation tax rate.

If a companies profits are over £250k, no marginal relief is claimable, CT is payable at 25% on the whole amount.

Whether a company has associated companies is also taken into consideration when calculating marginal relief.

You can calculate what your marginal relief may be using this calculator. Full details can be found on this government web page.

We’ve made some example calculations based on the dates 1st April 2023 to 31st March 2024:

Dividends

For 2023/24, the Dividend Allowance will be reduced from £2,000 to £1,000.

Dividends received above the allowance are taxed at the following rates for 2023/24:

8.75% for basic rate taxpayers

33.75% for higher rate taxpayers

39.35% for additional rate taxpayers

Corporation tax due on directors‘ overdrawn loan accounts will remain at 33.75%.

Dividends within the allowance will still count towards an individual’s basic or higher rate band, which may affect the rate of tax paid on dividends above the Dividend Allowance.

When calculating income tax, dividends are treated as the last type of income to be taxed. These changes will apply to the whole of the UK.

Capital Gains

CGT rates remain the same, however the annual exemptions will be reduced from the current £12,300 to £6,00 from 6th April 2023, and £3,000 from 6th April 2024.

CGT is calculated at the date you enter into an unconditional contract, so if you’re in the process of selling a property now, you’ll need to try to exchange contracts before 6th April 2023 to benefit from the current £12,300 allowance.